Today’s post starts with a story of human misjudgment and incentive-caused bias that would make even the most hardened capital allocator weep. It's a tale that perfectly illustrates what I call "the psychology of corporate parasitism."

Let me paint you a picture of our protagonist, we'll call him J.P. Masterful III. A Harvard MBA who understood one crucial thing: the modern corporate system is rife with exploitable governance gaps. Like a master poker player who's counted all the cards, J.P. knows that the real money isn’t in building value, but in extracting it.

The behavioral dysfunction started, as these things often do, with the board's desperate desire to appear proactive in their CEO search. They hired J.P. with what they called a "competitive compensation package." It was designed, reviewed and rubber stamped by a reputable compensation consultant who dutifully benchmarked the package to market, validating all previous packages and ensuring further compensation inflation in the process.

Here's where it gets interesting. J.P. understood the institutional imperative better than anyone. He knew that in large organizations, people don't just like flattery, they love it. So he built what he called a "ring of loyalists". All highly paid, all deeply invested in maintaining the illusion of his genius. It was like watching a cult form, except instead of religious devotion, they worshiped at the altar of stock options.

With his power consolidated J.P. next mastered the "art of temporal arbitrage." He knew exactly when to announce big initiatives (always just before his options vested). He could time corporate buybacks with the precision of an atomic clock. Somehow, he always managed to exercise his options at the peak. Funny that, isn't it?

The next key is mastering what I dub "strategic incompetence arbitrage." You see, J.P. knew that if he made himself simultaneously indispensable and potentially disastrous to replace, the board would hand out handsome pay rises for stability. J.P. spent a lot of his time convincing the board that his departure would be terrifying.

But here's the real secret: the more short-term metrics you can tie to compensation, the better. Who cares if cost-cutting decimates R&D? That's a problem for your successor, who will likely make you look good by comparison. J.P. added a healthy dollop of short-term incentives every year. Always remembering to negotiate when the board wanted him the most, not when they trusted him the least.

The real masterpiece was his exit strategy. Like a magician who knows exactly when to end the show, J.P. developed an uncanny ability to depart just before his short-term strategies revealed their long-term costs. He would start ambitious projects (always with great branding featuring the word “transformation”) knowing full well they were time bombs with fuses just long enough to explode on his successor's watch.

The piece de resistance? A lifetime consulting contract for his "invaluable wisdom", because apparently decimating a company's R&D budget and mortgaging its future wasn't enough. He needed a front-row seat to watch the aftermath, all while collecting a six-figure retainer.

Now, you might ask, where were the checks and balances? Where was the board oversight? Well, that's the beauty of what I call "responsibility diffusion." When everyone's responsible, no one's responsible. The board members, each successful in their own right, fell prey to what I call "authority bias meets social proof." If everyone else thinks J.P.'s a genius, who are they to disagree? Plus, what incentive do they have to admit they made a bad hire and approved an outrageous compensation package, when it will put them in the firing line?

In the end, J.P. walked away with enough money to buy a small island nation, while the company's long-term investors were left holding the bag. It's a perfect example of what happens when you combine intelligence, opportunity, and misaligned incentives.

The problem is, this isn’t fantasy. It’s real. It’s becoming the modern executive playbook, and it’s happening with increasing frequency at every senior level of the company, not just the top. More and more companies are suffering from this "incentive-caused bias” on steroids. Exactly the kind of behavior that should make you shudder as a shareholder.

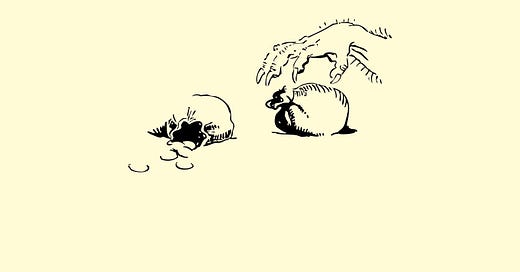

Some of you might think: “So what? That’s just shareholder money. I don’t worship at the altar of shareholder value creation.” But the money captured by executives isn’t extracted from shareholders alone. It's like taking water from the village well, every gallon diverted to an executive's private swimming pool is a gallon that can't be used to irrigate the fields that feed everyone else. A dollar spent on executive compensation is a dollar that could have been reinvested in R&D to drive innovation, lower prices for customers, or pay higher wages to employees.

Yet we repeatedly hand over the keys to hired hands and expect them to drive the car as carefully as they would their own. It's like hiring someone to diet for you, the incentives just don't align. We let these executives get rich from compensation packages that let them heads-I-win-tails-you-lose their way to wealth, while rarely making significant open-market purchases of their own company's stock.

Consider a telling example: A chairman I know hired a CEO who had $5 million in unvested stock with their previous employer. He graciously matched the grant with shares in the CEO’s new company. To his shock, the CEO immediately turned around and sold every share. "What about the optics?" he asked. The CEO's response was: "What optics?" They were her shares and she could do what she wanted with them. He should have structured the package more carefully, but he just couldn’t imagine a scenario where a senior leader would possibly do this. He didn’t understand the modern executive.

Yet this is how many modern executives think. The company's money is their money, just waiting to be released. It's like putting a bowl of candy in front of a child and expecting them not to eat it.

The solution lies in proper incentive alignment. Take Constellation Software's approach: Executives must invest 75% of their after-tax bonus in common shares on the open market, just like any other shareholder, with a four-year lockup period. That's real skin in the game, not paper wealth.

It's time we acknowledged this uncomfortable truth: The modern executive suite has become a wealth transfer mechanism, moving money from shareholders, customers, and employees to managers with ever-increasing efficiency. Like a Wall Street arbitrage desk, but without the risk.

As the saying goes, "The fish rots from the head down." And in the corporate world, that's exactly where we need to start fixing things.

Here’s what I want you to do next...

If you've found value in this post (and I think you have, since you've read this far), I have two small favors to ask:

Take 5 seconds to subscribe below. You'll get more posts like this, completely free.

Think of that one colleague or friend who's always sharing interesting ideas with you. You know who they are. Send them this post, they'll appreciate you for it.

That's all. Choose either. Or better yet, do both. Two tiny actions that take less than a minute but create lasting value for everyone involved.